san antonio local sales tax rate 2019

San Antonio Local Sales Tax Rate. The average combined rate of every zip code.

Understanding California S Sales Tax

The County sales tax.

. The latest sales tax rate for San Antonio TX. Is a veteran staff writer. The San Antonio sales tax rate is.

The property tax rate for the City of San Antonio consists of two components. 2020 rates included for use while preparing your income tax. Texas Comptroller of Public Accounts.

The Texas sales tax rate is currently. The latest sales tax rate for San Antonio NM. City sales and use tax codes and rates.

If you have questions about Local Sales and Use Tax rates or boundary information. Local Code Local Rate Total Rate. 0495 as of 2019 tax year.

This rate includes any state county city and local sales taxes. Jurors parking at the garage. San Antonio FL Sales Tax Rate.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Every 2019 combined rates mentioned. Published on September 20 2019 by Youngers Creek.

The portion of the sales tax rate collected by San Antonio is 125 percent. San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. The current total local sales tax rate in San Antonio TX is 8250.

The December 2020 total local. Published on June 25 2019 by. This is the total of state county and city sales tax rates.

Rates will vary and will be posted upon arrival. The minimum combined 2022 sales tax rate for San Antonio Texas is. Please consult your local tax authority for specific details.

Local Code Rate Effective Date. Some cities and local governments in Bexar County collect additional local sales taxes which can be as high as. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose.

The Fiscal Year FY 2022 MO tax rate is 34677 cents. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Published on September 20 2019 by Youngers Creek.

Maintenance Operations MO and Debt Service. The San Antonio Texas general sales tax rate is 625. This rate includes any state county city and local sales taxes.

Combined Area Name Local Code Rate. The portion of the sales tax rate collected by San Antonio is 125 percent. 2020 rates included for use while preparing your income tax deduction.

1000 City of San Antonio. The San Antonio sales tax rate is.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sales Tax Rates In Major Cities Tax Data Tax Foundation

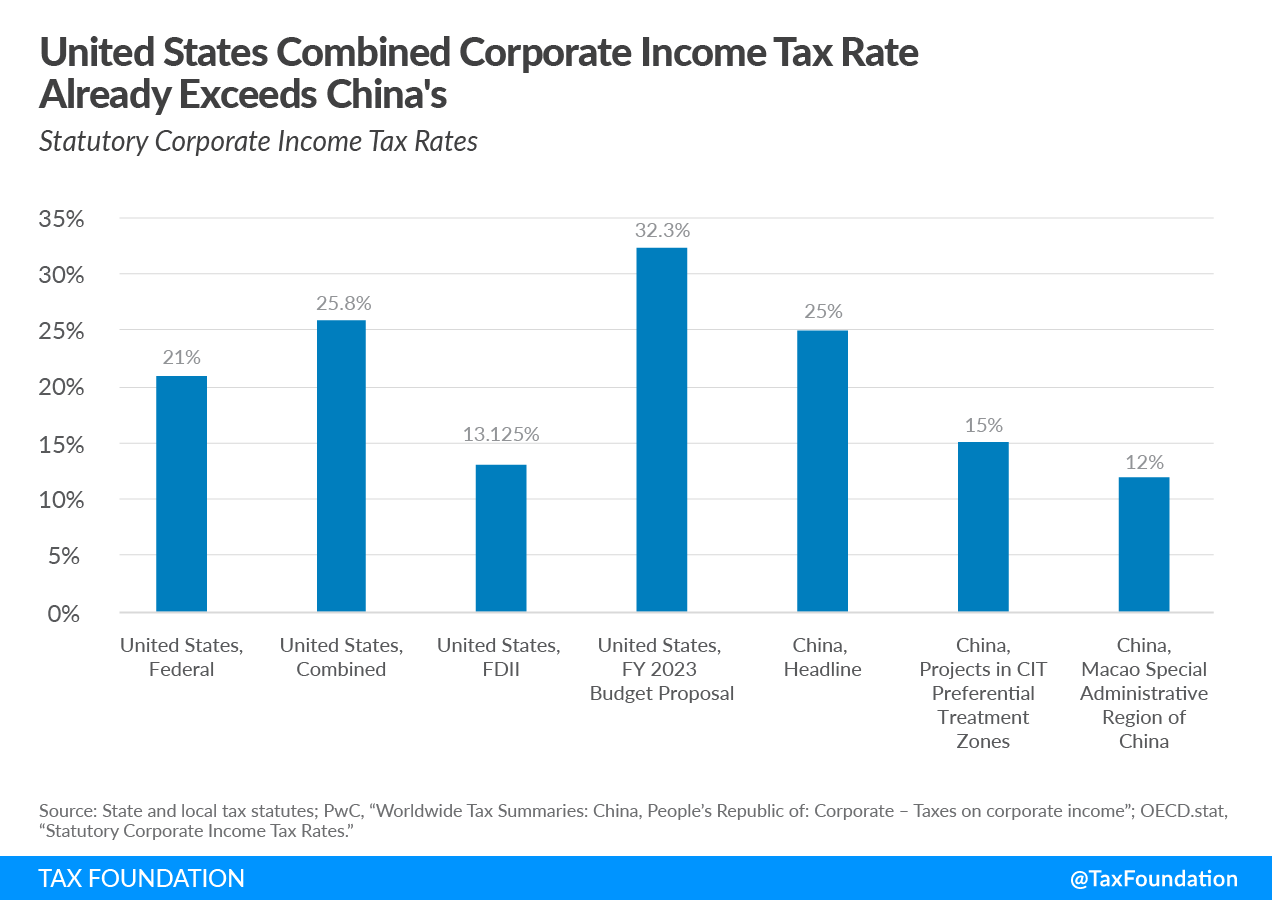

Tax Proposals Comparisons And The Economy Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Texas Sales Tax Guide For Businesses

Build Back Better Act Tax Foundation

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

Movimiento Audible Panel Fiscal Code Germany Continuar Diligencia Recoger

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org